2023 in Review: A Challenging Year

Despite facing persistent headwinds, the United States homebuilding industry proved to be resilient

The past year was a difficult one for the United States housing market, as it faced multiple headwinds that dampened both the demand and supply of homes. Mortgage rates soared to their highest levels in decades, affordability reached a historic low and inventories remained tight across the country. Despite these challenges, the housing market proved to be resilient, faring much better than many analysts had anticipated.

Mortgage Rates: Higher for Longer

The biggest drag on the housing market in 2023 was the rise in mortgage rates, reaching nearly 8% in October. Several factors contributed to the increase including the Federal Reserve’s aggressive monetary policy tightening, rate volatility and concerns surrounding the ballooning national debt.

Higher mortgage rates reduced the purchasing power of homebuyers, especially first-time buyers. As a result, the monthly payment on a median-priced home with a 20% down payment rose from $1,900 to nearly $2,300 by the end of the year. Affordability is at its lowest level since the early 1980s, particularly in the West and coastal markets.

On the supply side, higher interest rates discouraged existing homeowners from selling their homes. With nearly two-thirds of all outstanding mortgages carrying interest rates below 4%, owners who sold would face a significant payment shock on a new mortgage. Property and capital gains taxes are additional deterrents given the strong home price appreciation since 2020. As a result, the inventory of existing homes for sale fell to its lowest level on record.

Existing and New Home Sales: A Tale of Two Markets

While lack of mortgage affordability has reduced the number of eligible homebuyers, underlying demand for homes remained strong, given demographics and the desire for more space.

Sales trends for existing and new homes diverged significantly, reflecting the different dynamics of supply and demand in each market. Existing home sales reached an annualized rate of 4.4 million units in September 2023, their lowest level since October 2010.

Conversely, new home sales were running at an annualized rate of 685,000 units through September, up 5% from last year. For motivated homebuyers, new construction offered an opportunity to move into a home quickly given the dearth of existing homes for sale. Builders further supported the demand by offering interest rate buydowns and other incentives.

House Prices: A Mixed Picture

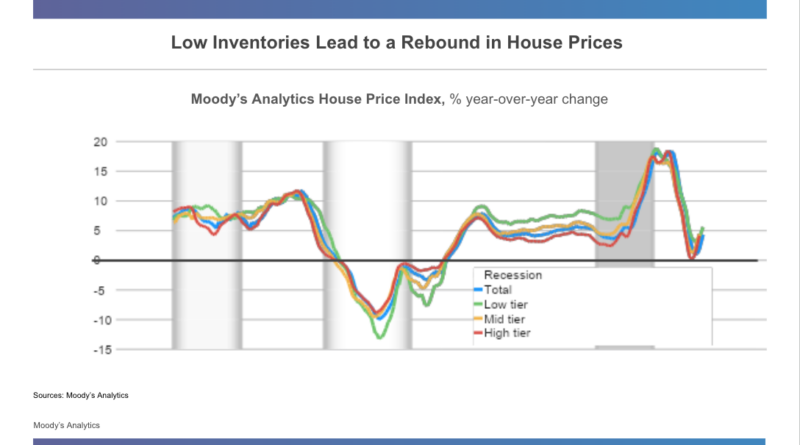

House price growth decelerated sharply to start the year after peaking at just over 18% on a year-over-year basis in 2022. Growth bottomed at 1% in May before reaccelerating to over 4% by September. The lower-priced segment of the market experienced stronger price growth than the higher-priced segment, as buyers faced more competition for limited inventory at the entry-level.

House price trends varied considerably by region with year-over-year price declines of 5% or more in markets such as San Francisco, Seattle, Austin, Texas, and Boise, Idaho. Annual gains of 10% or more were reported throughout the Midwest and selected markets in Texas, Florida and the Northeast. The divergence largely reflects the migration patterns of homebuyers who sought more affordable and spacious living options.

Homebuilding: A Bright Spot

Robust new home construction activity was one of the brighter aspects of the housing market in 2023. Homebuilders were quick to respond to affordability challenges by shifting their production towards lower-priced homes and by offering lower interest rates through preferred lenders.

Although the pace of new permits and starts declined, short-term construction activity will remain strong given the near-record number of homes under construction. The longer-term prospects for the industry remain bright given low vacancy rates and the large number of young adults in their prime home-buying years. The housing market would need to add an estimated 1.5 million units in addition to trend growth to return the vacancy rate to its equilibrium.

Parting Thoughts

While 2023 was a challenging year for the housing market, performance was much better than expected given sky-high mortgage rates and significant economic uncertainty. Although a slowing economy will drag on homebuilding activity in the near term, favorable underlying fundamentals will carry the industry in a positive long-term direction.

Cristian deRitis is the deputy chief economist at Moody’s Analytics where he specializes in the analysis of broad economic conditions and housing.