Fed Pauses Again: Housing in Focus

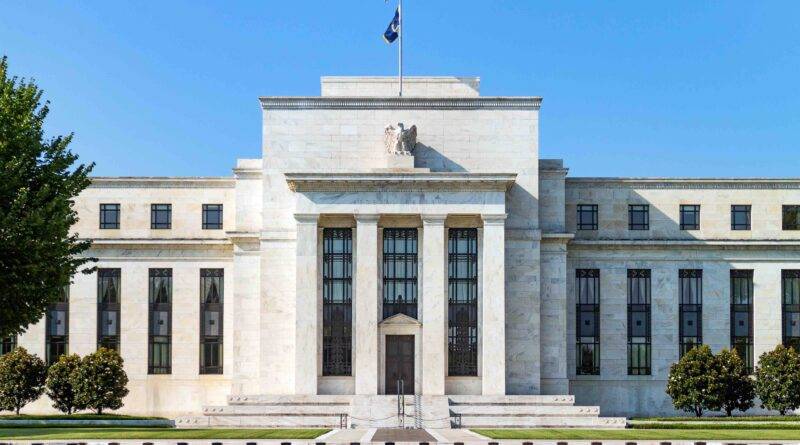

The monetary policy committee for the Federal Reserve convened for their November meeting, holding the federal funds rate at a top target rate of 5.5% at the conclusion of the meeting. This marked the second meeting in a row of no increase as the central bank examines incoming data, though the Fed was “strongly” committed to reducing inflation to its target rate.

The Fed made a statement, acknowledging that it would be guided by future inflation and economic data in determining whether it would hold again at its December meeting. The statement noted it, “…will continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

According to Eye On Housing, the Fed also stated that it will continue to reduce its balance sheet holdings of Treasuries and mortgage-backed securities (MBS) as part of quantitative tightening. This roll off for the central bank’s balance sheet is a key reason why the spread between the 10-year Treasury rate and the 30-year fixed rate mortgage is elevated. Compared to a 160-180 basis points spread after the Great Recession and before Covid, the difference between these long-term rates has recently been as a high as 300 basis points.