Sales Activity Driven by the Five Ds Amid Persistent Market Headwinds

Home sales are expected to rise driven by lifestyle changes and significant life events

By Odeta Kushi

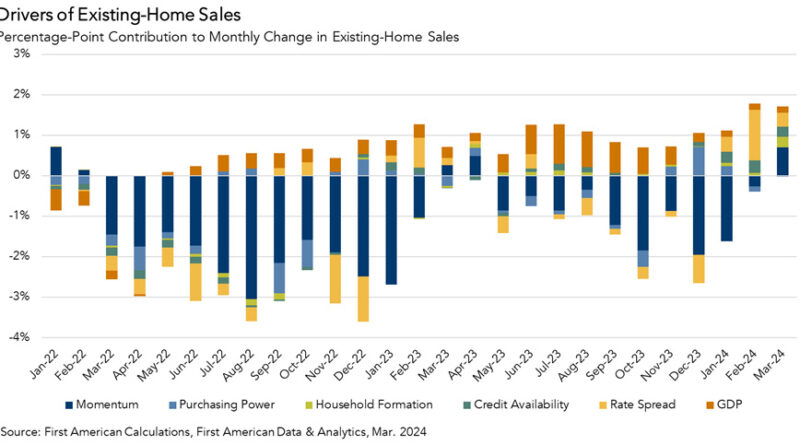

Our Existing-Home Sales Outlook Report ‘nowcasts’ existing-home sales based on the historical relationship between sales, demographic trends, house-buying power and the prevailing financial and economic conditions. Based on our nowcast, we expected the March existing-home sales to rise 1.7% compared with February, but to remain approximately 16% lower than one year ago. The month-over-month progress is welcoming news for a housing market that has struggled to gain momentum. What could be driving the uptick in sales activity?

The Five D’s Drive Sales Activity

Today’s housing market faces a persistent trio of challenges. The mortgage rate lock-in effect, limited inventory of homes for sale and constrained affordability continue to dampen sales activity and will likely remain headwinds for the remainder of 2024. Yet, despite these challenges, the existing-home sales outlook has increased for two consecutive months. While financial considerations are important in the decision to buy or sell a home, so too are lifestyle choices and events, such as the five Ds – death, divorce, diplomas, downsizing and diapers.

In fact, household formation was a primary driver of growth in our Existing-Home Sales Outlook Report in March, as millennials continued to age into their prime home-buying years and make lifestyle choices that are highly correlated with buying a home, such as getting married and having children. Additionally, the pandemic untethered many workers from their employer’s office location. Because of the pandemic-driven uptick in remote work, where one lives today is much less correlated with where one works. Homeowners are also sitting on historically high levels of equity, so for some homeowners moving and taking on a higher interest rate isn’t a big deal if one needs to move—especially if they are moving to a more affordable area or downsizing.

While “life happens” events may spur some buyers and sellers, it’s not enough to fuel the housing market to more normal sales levels. Existing homes represent the majority share of inventory, and nearly 90% of existing homeowners are locked into rates below 6% and financially disincentivized from selling. In the housing market, the seller and the buyer are, in many cases, the same. To buy a new home, you have to sell the home you already own. The rate lock-in effect will likely weaken if the Federal Reserve cuts rates and mortgage rates fall.

The March Consumer Price Index data showed inflation continued to reaccelerate, so the Federal Reserve still does not have the economic justification it needs to begin rate cuts anytime soon, meaning rate cuts in June seem like a long shot at this point. However, it still seems more likely than not that short-term rates will decline towards the end of this year. Even then, mortgage rates aren’t likely to decrease enough to ‘unlock’ most homeowners, so in the interim, the driving force behind sales activity will remain the five Ds.

March 2024 Existing-Home Sales Outlook

For the month of March, First American updated its Existing-Home Sales Outlook to show that: existing-home sales are expected to increase 1.7% from February’s pace of sales; our projected March seasonally adjusted annualized rate is down 16% compared with the predicted pace of sales a year ago; and the largest contributors to the projected monthly change are sales momentum (+0.7 percentage points), decline in the mortgage rate spread between the current and effective rates (+0.3 percentage points), household formation (+0.3%), greater credit availability (+0.3 percentage points) and a boost in economic conditions (+0.2 percentage points).Odeta Kushi is the deputy chief economist at First American Financial Corporation.